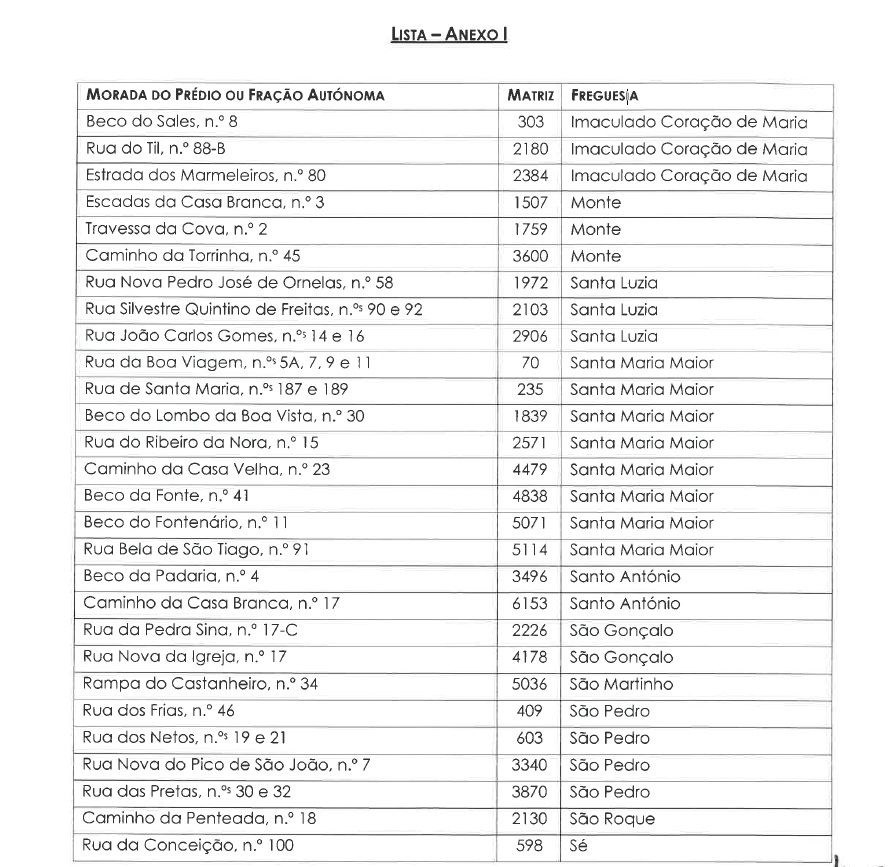

Last week, Funchal City Council published a list of 28 buildings or units that are vacant. This is the fourth list of degraded or abandoned properties drawn up by the municipality in recent years. Now almost all parishes in the municipality are covered – Imaculado Coração de Maria, Monte, Santa Luzia, Santa Maria Maior, Santo António, São Martinho, São Pedro, São Roque and Sé. What could happen to this private heritage?

For now, this is a provisional list, which is intended to prepare for a possible 30% increase in Municipal Property Tax (IMI) for buildings that are in poor condition. For the purposes of applying the IMI rate, an urban building or autonomous unit that is unoccupied for a year is considered vacant. Signs of vacancy are the lack of contracts in force with telecommunications and water, gas and electricity supply companies and the lack of invoicing for the consumption of these services.

To the owners of the buildings included in this list, the Funchal City Council gives a period of 10 days to exercise the right to a prior hearing, invoking some of the exceptions provided for in Decree-Law no. 159/2006, of 8 August.

To the owners of the buildings included in this list, the Funchal City Council gives a period of 10 days to exercise the right to a prior hearing, invoking some of the exceptions provided for in Decree-Law no. 159/2006, of 8 August.

Under the terms of this diploma, an urban building or autonomous unit intended for housing for short periods on beaches, countryside, spas and any other vacation spots, for temporary rental or for personal use, is not considered vacant. Buildings where rehabilitation works certified by the municipalities are taking place or whose construction was completed or the issuance of a use license took place less than a year ago cannot be considered vacant. Properties acquired for resale also escape this classification, as long as they have benefited or will benefit from exemption from municipal tax on onerous property transfers and during a period of three years counting from the date of acquisition. Residence in the national territory of a Portuguese emigrant or Portuguese citizen who carries out work abroad in the service of the Portuguese State, international organizations or functions of recognized public interest cannot be considered vacant either.

If the owners are unable to prove any of these exceptions, the Funchal City Council draws up the definitive list of vacant buildings and communicates it to the Tax and Customs Authority, which will deal with the application of the increased IMI rate.

The Municipal Property Tax Code (CIMI) determines that revenues obtained from the increase in this tax can only be used by municipalities to finance municipal housing policies.